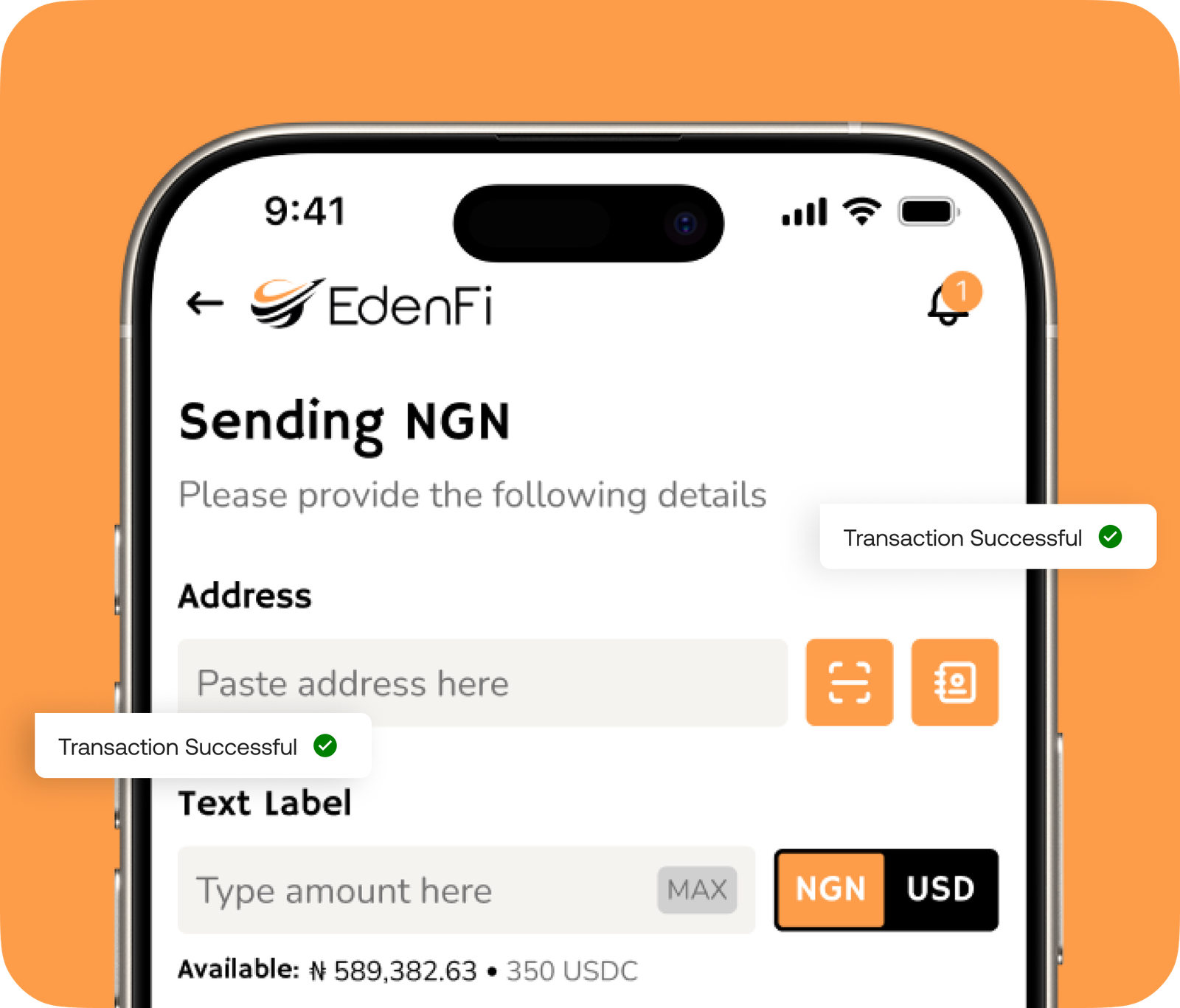

Send money across borders in seconds with EdenFi. Fast, secure, and hassle-free transfers at the click of a button.

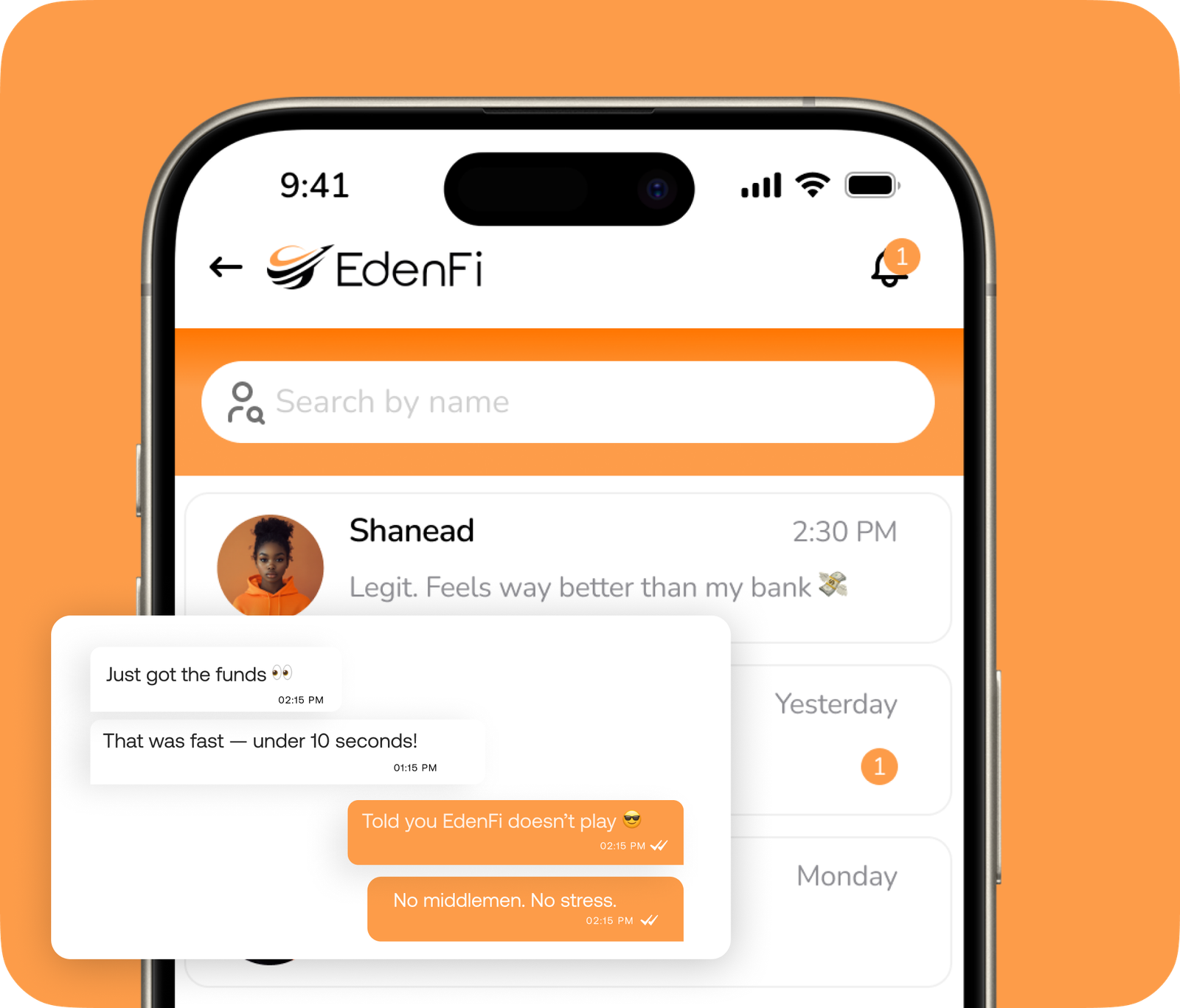

Forge stronger relationships with EdenFi’s social features. Send messages to anyone in the world as long as they have EdenFi too.

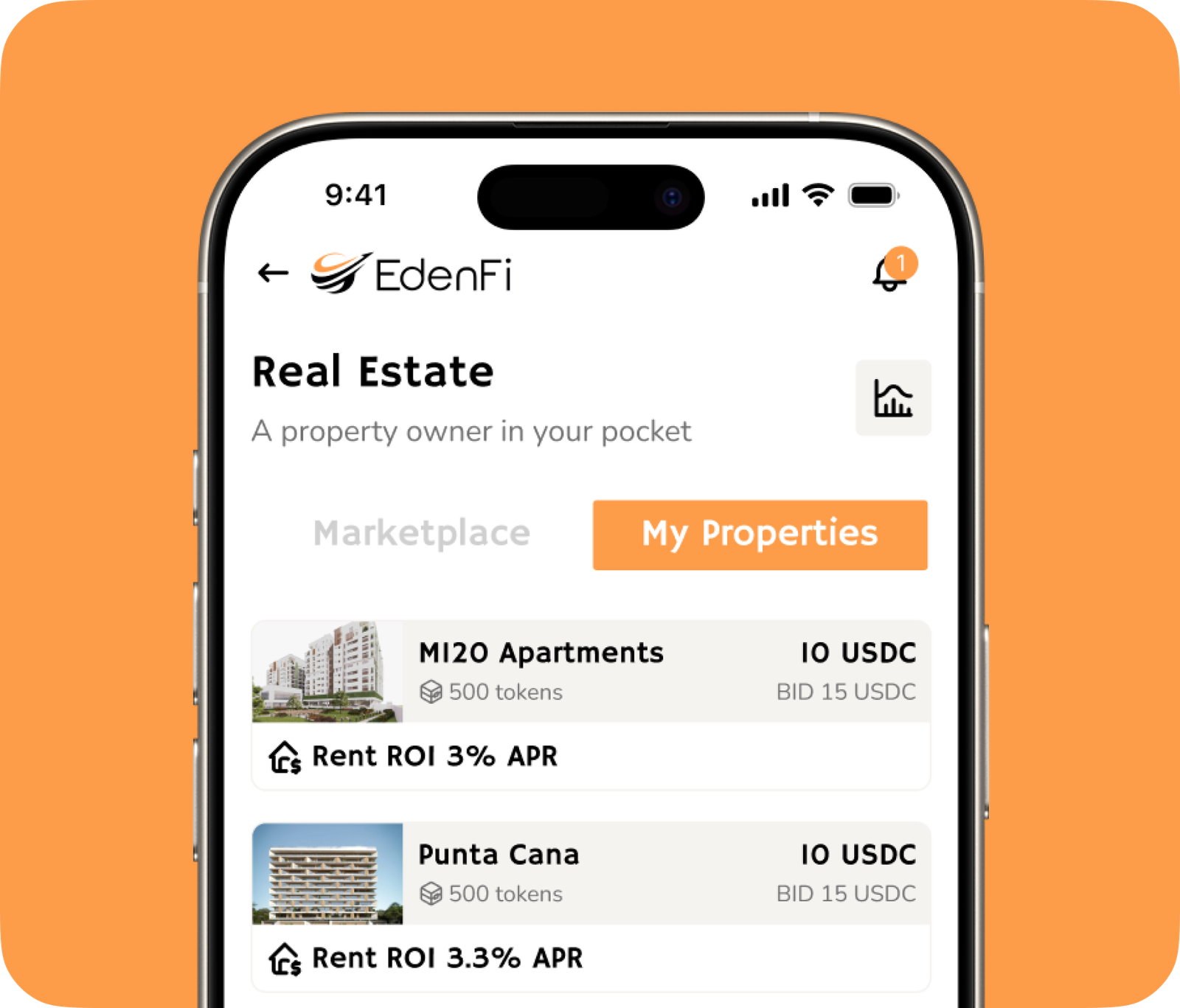

Build your property portfolio in seconds with EdenFi. Secure, seamless transactions that put prime real estate at your fingertips.

Here’s what you can do: ➺ Send money in just 10 seconds with no delays. ➺ Invest in real estate back home, starting from just $10. ➺ Chat with family without hopping from one app to another. That’s the smooth, stress free experience we’ve all been waiting for. You don’t need to be rich to start. You just need a place to start and EdenFi gives you that.

At EdenFi, a percentage of all transaction fee revenue is donated to a charity or social cause chosen by the EdenFi community each month. Causes may include education, healthcare, or infrastructure development projects across Africa. Users get to vote making EdenFi a platform built for Africans, by Africans.

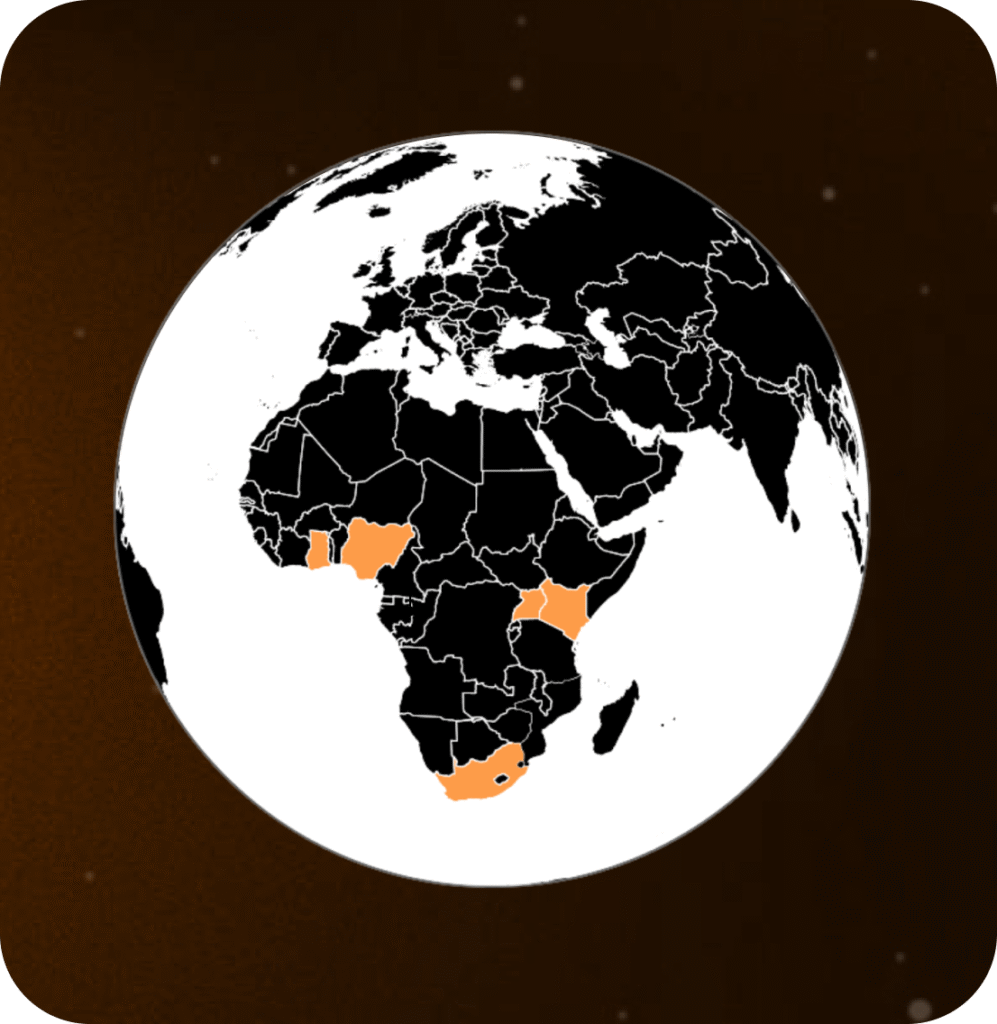

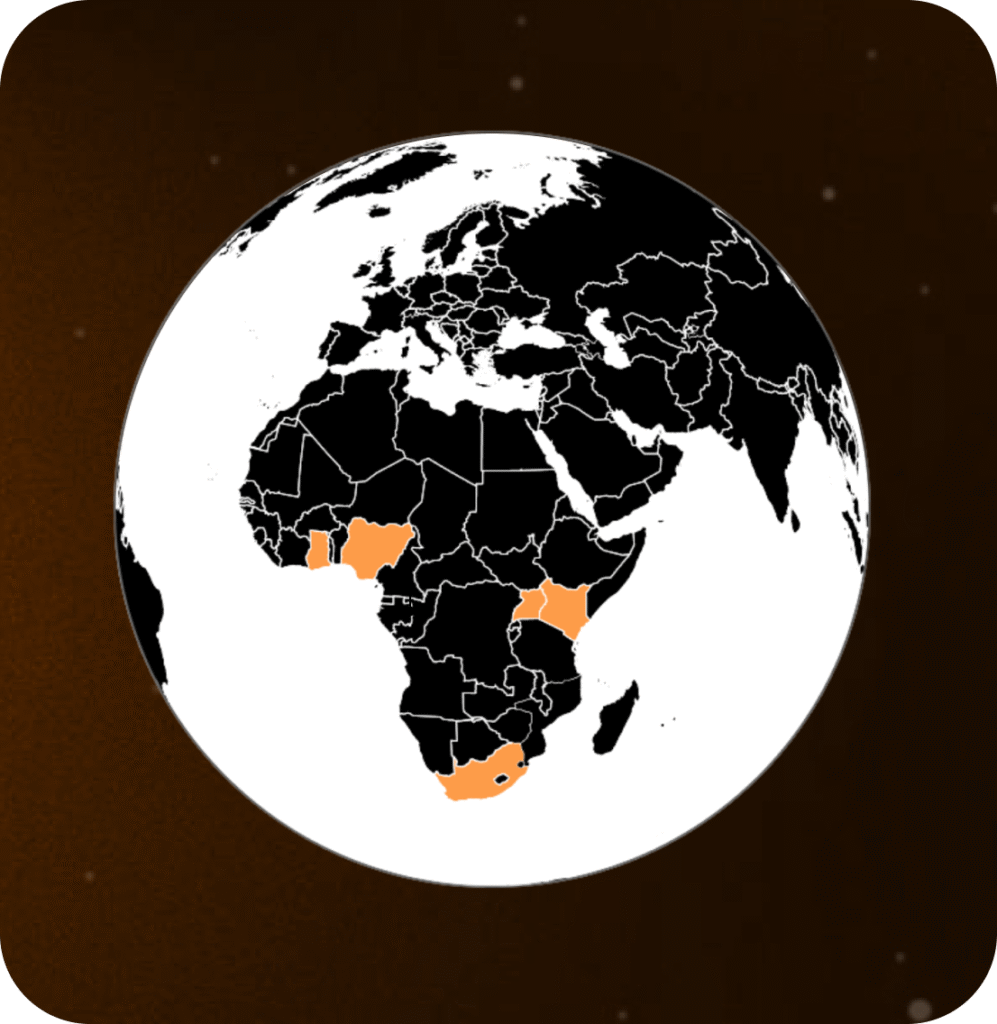

EdenFi is Africa’s first smart wallet combining instant stablecoin transfers, real estate investing, and social connectivity. Unlike Revolut or MetaMask, EdenFi is built specifically for Africans, with low transfer fees, a real estate marketplace, lower FX markups than Western Union and LemFi, plus localised off-ramp support in key markets like Nigeria, Ghana and South Africa.

Using EdenFi is free to download and join.

Your funds stay under your control thanks to EdenFi’s self-custodial smart wallet powered by blockchain.

We use bank-grade encryption, multi-factor authentication, and full compliance to ensure your assets and personal data are always protected.

EdenFi leverages stablecoins (USDC) and low-fee off-ramps to deliver funds to Nigeria, Ghana, and other African countries within seconds.

Stablecoins are no longer abstract digital assets in Africa, they are practical financial tools used every day for payments, remittances, savings, and cross-border trade. At the centre of this shift

Cross-border remittances are a lifeline for millions of households across Africa. Every year, billions of dollars flow into economies, supporting families, fuelling small businesses, and sustaining local markets. Yet despite

Stablecoins are digital assets designed to maintain a stable value by being pegged to fiat currencies, most commonly the US dollar. Unlike volatile cryptocurrencies, stablecoins provide price stability while retaining